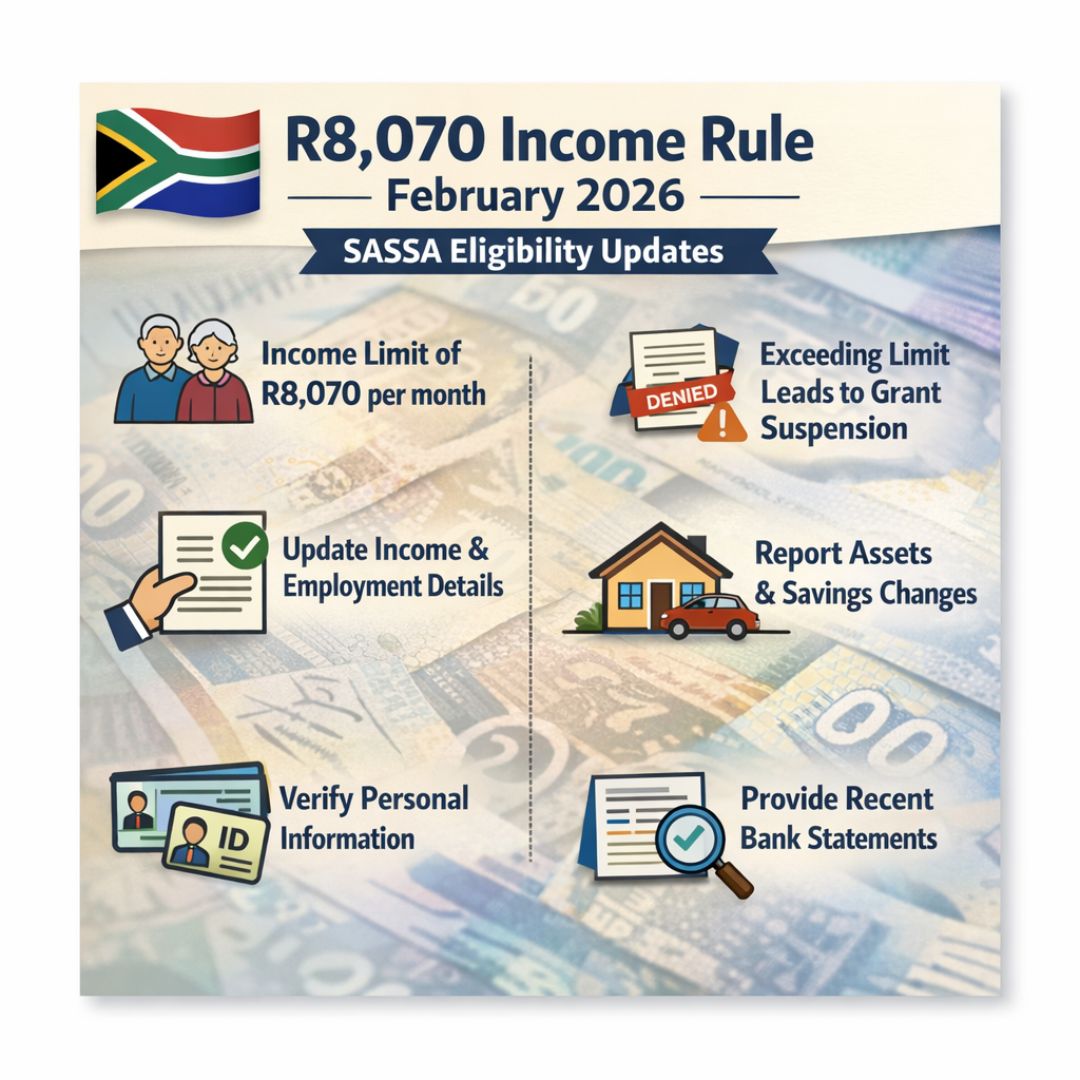

The South African Social Security Agency (SASSA) has announced a new rule about income eligibility that will start on February 10 2026. This change will affect social grant recipients across the country. Under the new rule people who earn more than R8,070 per month may see their grants reduced or stopped entirely. The change aims to direct grants toward the households that need them most & make the system fairer & more sustainable.

Why SASSA Introduced a New Income Threshold

The revised income cap of R8,070 per month forms part of SASSA’s efforts to strengthen the sustainability of South Africa’s social assistance system. With budget constraints and a growing number of applicants placing pressure on available funds, the agency has found it necessary to apply tighter income verification measures. This approach is designed to maximize the impact of social grants while ensuring that government support is distributed fairly and reaches households with the greatest financial need.

Who Will Be Affected by the New Rule

The R8,070 income limit applies to most means-tested SASSA grants, including the Old Age Grant, Disability Grant, and Child Support Grant. If the combined income of all adults living in a household exceeds this threshold, beneficiaries may see their grants reduced or fully withdrawn. Existing grant recipients will be required to verify their income details, as SASSA will begin reviewing eligibility based on the most up-to-date information from February 10, 2026.

Goodbye to Low Old Age Pension: Monthly Senior Payments Increase Up to R2,400 from 8 February 2026

Goodbye to Low Old Age Pension: Monthly Senior Payments Increase Up to R2,400 from 8 February 2026

How SASSA Will Apply the Income Limit

Starting February 10, 2026, SASSA will enforce the new income criteria for new applications and grant renewals. Beneficiaries may be asked to submit supporting documents, such as an employer-issued income letter, payslips, or bank statements. If a household’s income is found to be above R8,070, the grant may be temporarily reduced or cancelled entirely. Affected recipients will be notified and given an opportunity to clarify or explain their income circumstances where necessary.

What Beneficiaries Should Do to Remain Eligible

To avoid disruptions, beneficiaries are encouraged to review and update their income details before February 10. Maintaining accurate and complete income records is essential for uninterrupted access to social grants. Updates can be completed at SASSA offices or through official online platforms, and beneficiaries should retain documentation for all income sources.

Assistance Options for Affected Families

Households impacted by the new income rule may still be eligible for alternative support programmes or local assistance services. Community organisations and welfare offices can offer guidance to families facing grant reductions or suspensions, helping ensure access to temporary financial support during the adjustment period.