The South African Social Security Agency (SASSA) has officially confirmed that new banking and payment regulations will be introduced from 2026. These changes will affect how millions of beneficiaries receive their monthly grants. The updated rules are designed to strengthen payment security, reduce fraud, and ensure grant funds reach the correct recipients without unnecessary delays.

Why SASSA Is Introducing New Banking Rules

In recent years, SASSA has faced ongoing challenges related to incorrect banking details, identity verification issues, and fraudulent payment claims. The new banking regulations aim to address these problems by improving verification processes and enforcing stricter controls over how grant payments are distributed. The goal is to build a more reliable and efficient payment system for beneficiaries.

New Requirements for Bank Account Verification

From 2026, beneficiaries will be required to register a bank account that is held in their own name and matches the identity details recorded by SASSA. Payments made to third-party accounts that do not meet these requirements may be delayed or declined until verification is completed. Accounts that are dormant, closed, or show irregular activity may also trigger temporary payment suspensions.

Impact on Monthly Grant Payments

While the new regulations introduce stricter controls, the value of monthly grants will remain unchanged. However, beneficiaries who fail to update or confirm their banking details may experience delays in receiving their payments. SASSA has advised all grant recipients to review and confirm their payment information well before scheduled payout dates to avoid disruptions.

Digital and Biometric Checks Expanded

As part of the 2026 system upgrades, SASSA will expand the use of digital and biometric verification methods. Beneficiaries may be required to verify their identity using fingerprints or other secure authentication methods at approved pay points. These measures are intended to prevent unauthorized access to grant funds while ensuring legitimate beneficiaries are paid correctly.

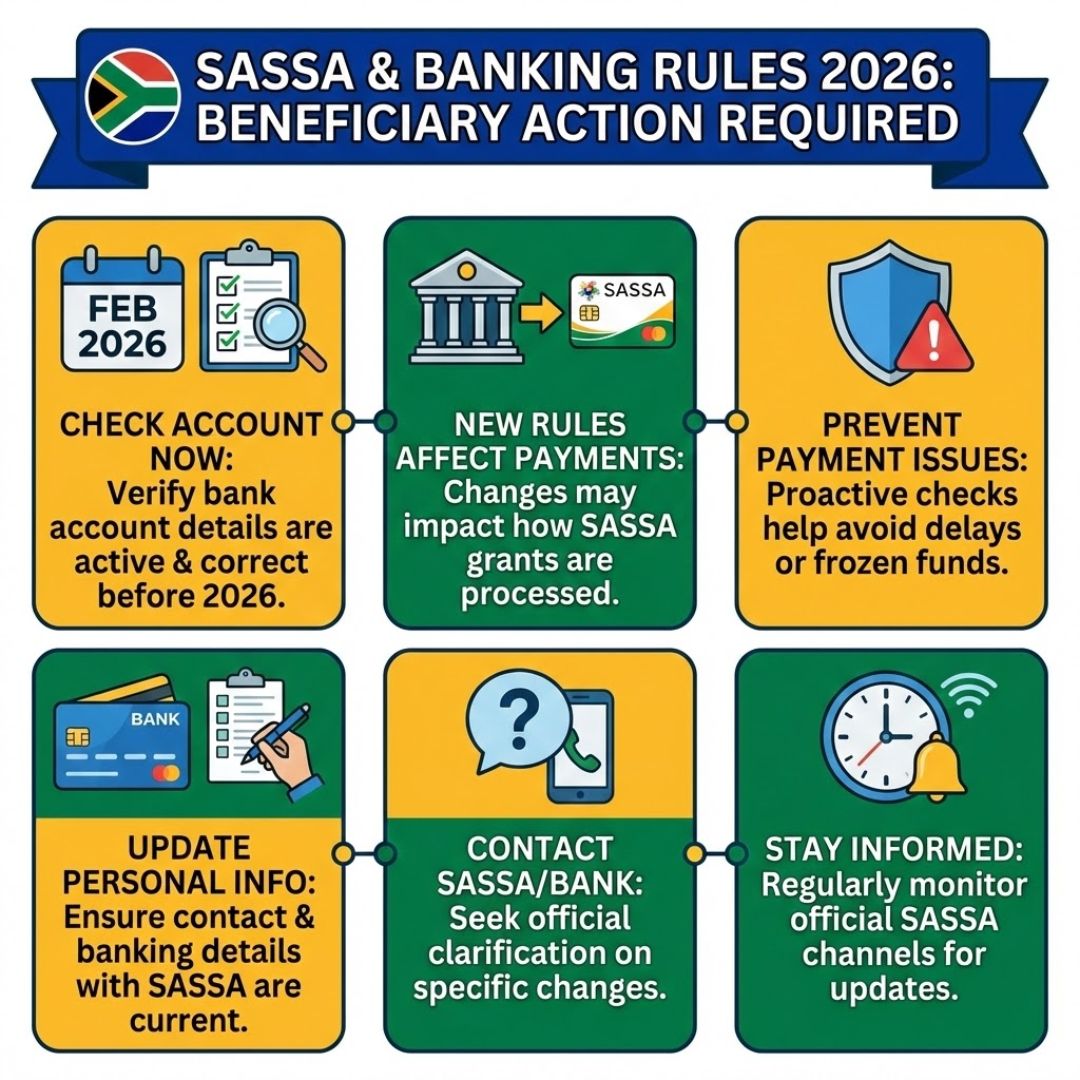

What Beneficiaries Should Do Now

SASSA is encouraging all beneficiaries to update their banking information as soon as possible. Changes can be made at authorized SASSA offices or through official SASSA online platforms. It is also important for beneficiaries to keep their contact details up to date, as SASSA uses these channels to send verification requests and payment-related notifications.

Consequences of Not Updating Banking Details

Beneficiaries who do not comply with the new banking requirements may face payment delays until their information is verified. In cases where records are incorrect or incomplete, beneficiaries may need to visit a SASSA office in person to resolve the issue. Taking early action will help avoid payment interruptions and financial stress once the new rules come into effect.