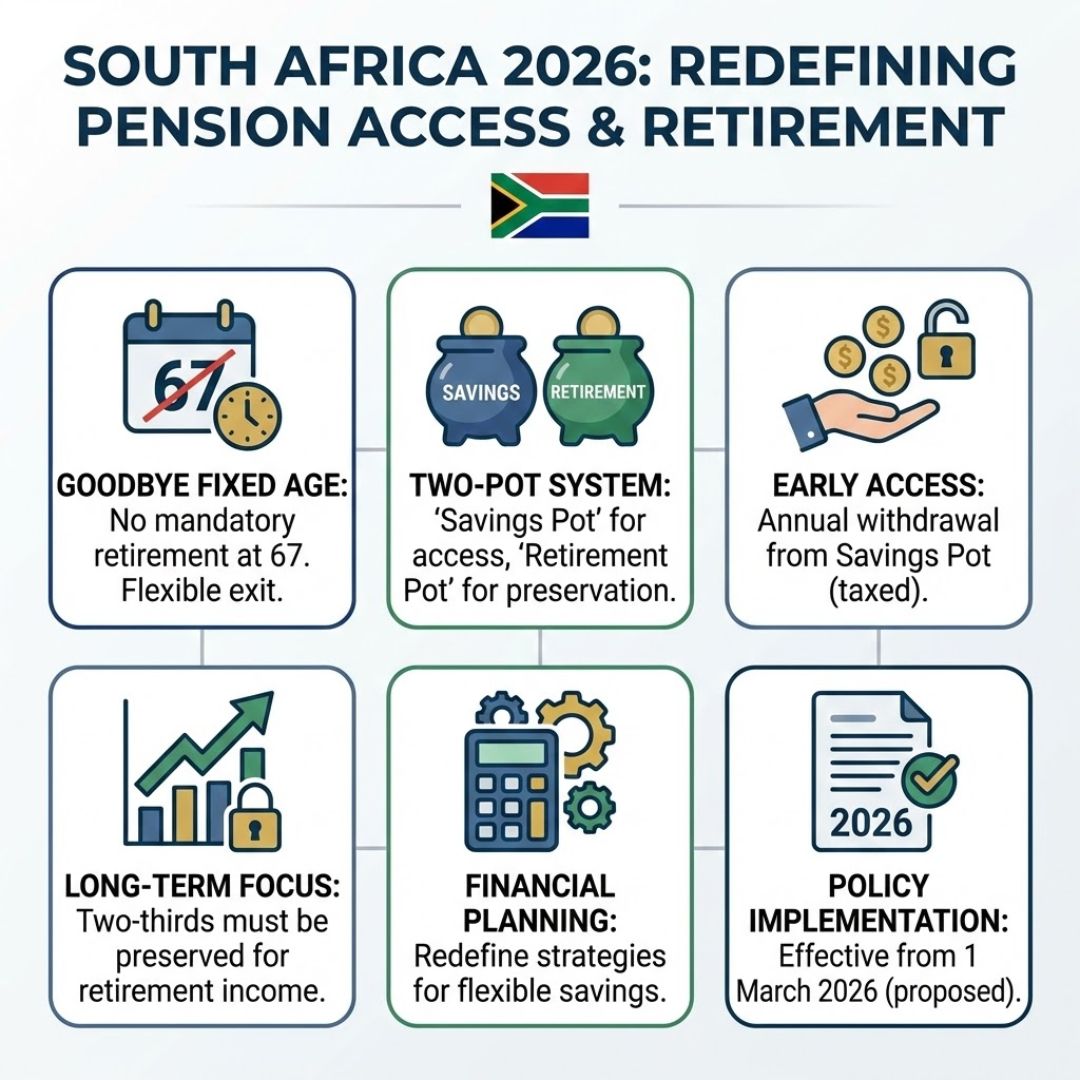

South Africa is entering a major transition in how retirement is defined, accessed, and planned. The long-standing idea of retiring strictly at age 67 is now being reconsidered as policymakers respond to economic pressure, longer life expectancy, and changing work patterns. In 2026, new discussions and policy directions are expected to reshape pension access, especially for older workers who remain active or financially vulnerable. For many South Africans, this shift is not just about age limits, but about fairness, sustainability, and realistic retirement planning in a country facing rising living costs.

South Africa Redefines Retirement Age Rules

For decades, retirement at 67 was treated as a fixed milestone, but South Africa is now challenging that assumption. Policymakers argue that a single retirement age no longer reflects modern realities, especially with people living longer and working differently. The proposed changes focus on flexible retirement thresholds, allowing individuals to exit the workforce earlier or later depending on circumstances. Officials are also reviewing income security gaps faced by older citizens who cannot continue working. By aligning retirement rules with changing workforce patterns, the government hopes to reduce inequality while improving access to pensions. This shift could also ease pressure on employers and public funds, creating a more adaptable system.

Pension Access Changes and Eligibility Planning

Redefining retirement does not automatically mean cutting benefits; instead, the focus is on smarter access. South Africa is exploring ways to link pensions to years of contribution rather than age alone. This could benefit workers who started young or faced unstable employment. Authorities are also considering means testing adjustments to better support low-income retirees. For individuals, this means retirement planning must begin earlier, with attention to savings, work history, and eligibility rules. By improving pension access fairness, the system aims to support vulnerable groups while ensuring long-term sustainability for future generations.

Retirement Planning in 2026 and Beyond

As 2026 approaches, South Africans are being encouraged to rethink how they prepare for later life. Financial advisors emphasize longer working lives combined with diversified savings strategies. The government is also promoting personal retirement readiness through awareness campaigns and clearer guidance. For many households, rising costs make early financial planning essential, not optional. These reforms signal that retirement is becoming a transition rather than a fixed endpoint. Understanding policy updates and adapting personal plans will be key for anyone approaching retirement age in the coming years.

What These Changes Mean for Ordinary Citizens

For everyday South Africans, redefining retirement brings both uncertainty and opportunity. While some fear delayed access to benefits, others welcome the chance for greater retirement choice. The reforms aim to balance public finances with social protection, ensuring future pension stability. Citizens who stay informed can better align work, savings, and lifestyle decisions. Ultimately, the success of these changes depends on clear communication and trust. With thoughtful implementation, South Africa could create a retirement system that reflects real lives rather than rigid numbers.

| Aspect | Current Approach | Proposed Direction |

|---|---|---|

| Retirement Age | Fixed at 67 | Flexible age range |

| Pension Eligibility | Age-based | Age and contribution |

| Planning Focus | Late-stage planning | Earlier preparation |

| Support Model | Uniform benefits | Targeted assistance |

Frequently Asked Questions (FAQs)

1. Is retirement at 67 ending in South Africa?

The age is being reconsidered, not removed, with more flexible options proposed.

Number Plate System 2026: South Africa’s New Rules Explained and What Drivers Must Prepare For Now

Number Plate System 2026: South Africa’s New Rules Explained and What Drivers Must Prepare For Now

2. Will pension payments be reduced?

No reductions are confirmed; changes focus on access and eligibility, not cuts.

3. Who benefits most from the new approach?

Workers with long contribution histories and low incomes may benefit the most.

4. When will these retirement changes take effect?

Major policy shifts are expected to be discussed and phased in during 2026.