South Africa’s social grants system is entering a stricter phase as the South African Social Security Agency (SASSA) issues a clear warning to beneficiaries ahead of 15 February 2026. The focus is firmly on unreported income, which authorities say undermines fairness and delays support for those truly in need. With improved data-sharing and verification tools now in place, SASSA is stepping up efforts to identify discrepancies. For millions who rely on grants, understanding these changes is essential to avoid unexpected suspensions and financial disruption.

SASSA unreported income checks intensify

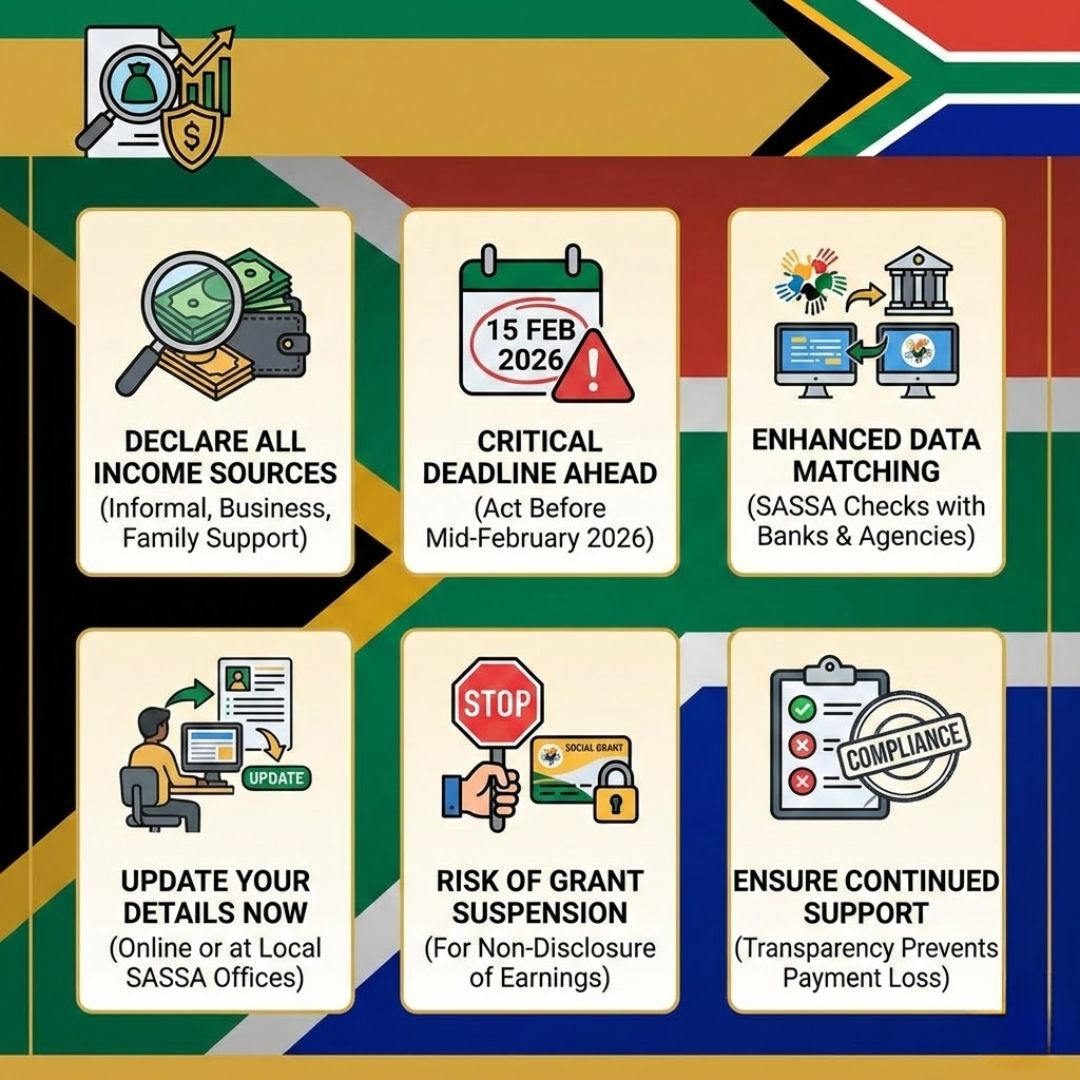

SASSA has confirmed that its approach to income verification will become far more rigorous in early 2026. By cross-checking beneficiary details against banking, employment, and tax records, the agency aims to close gaps that allowed undeclared earnings to slip through. Officials stress that income verification process upgrades are not meant to punish honest recipients, but to protect the integrity of grants. Many suspensions stem from data mismatch alerts rather than deliberate fraud. Still, ignoring notices can trigger automatic grant reviews. Beneficiaries are urged to act early, as compliance deadlines matter and delays could lead to temporary or permanent payment loss.

Grant suspensions linked to undeclared earnings

Grant suspensions often occur when beneficiaries fail to disclose changes in their financial situation. Even small amounts from casual work or family support can affect eligibility if not reported. SASSA says undeclared income risks have grown as monitoring systems improve. The agency encourages transparency, reminding recipients that partial income disclosure is better than none at all. Many cases can be resolved through updated beneficiary records if action is taken quickly. Ignoring communication, however, increases the chance of payment interruption notices being issued before February 2026.

What SASSA expects before February 2026

Before the 15 February 2026 deadline, SASSA expects all beneficiaries to review and confirm their financial details. This includes bank accounts, employment status, and any new income sources. The agency highlights proactive self-reporting as the safest way to remain compliant. Online and in-person channels are available for grant detail updates, making the process more accessible. Failure to respond may result in temporary payment freezes, which can only be lifted after verification. Staying informed and responsive now reduces the risk of long review delays later.

Why this warning matters for grant recipients

This warning signals a broader shift toward accountability within South Africa’s social assistance system. As public funds face increasing pressure, SASSA is under scrutiny to ensure grants reach eligible households only. For beneficiaries, the message is clear: accuracy builds trust and helps maintain long-term support. While stricter checks may feel unsettling, they also promote system-wide fairness. Those who engage early benefit from smoother verification outcomes, while last-minute responses risk stress and delays. Ultimately, transparency now supports sustainable social grants for the future.

| Grant Aspect | Key Detail | What Beneficiaries Should Do |

|---|---|---|

| Income Reporting | All income must be declared | Update details immediately |

| Verification Period | Ongoing until Feb 2026 | Respond to SASSA notices |

| Risk of Suspension | High for mismatches | Check records regularly |

| Resolution Time | Varies by case | Submit documents early |

Frequently Asked Questions (FAQs)

1. What counts as unreported income?

Any earnings or financial support not disclosed to SASSA counts as unreported income.

2. Will all grants be checked before February 2026?

Yes, SASSA plans broad verification across all major grant categories.

3. Can a suspended grant be reinstated?

Yes, once required information is verified and approved.

4. How can beneficiaries update their details?

Updates can be made through SASSA offices or approved online channels.