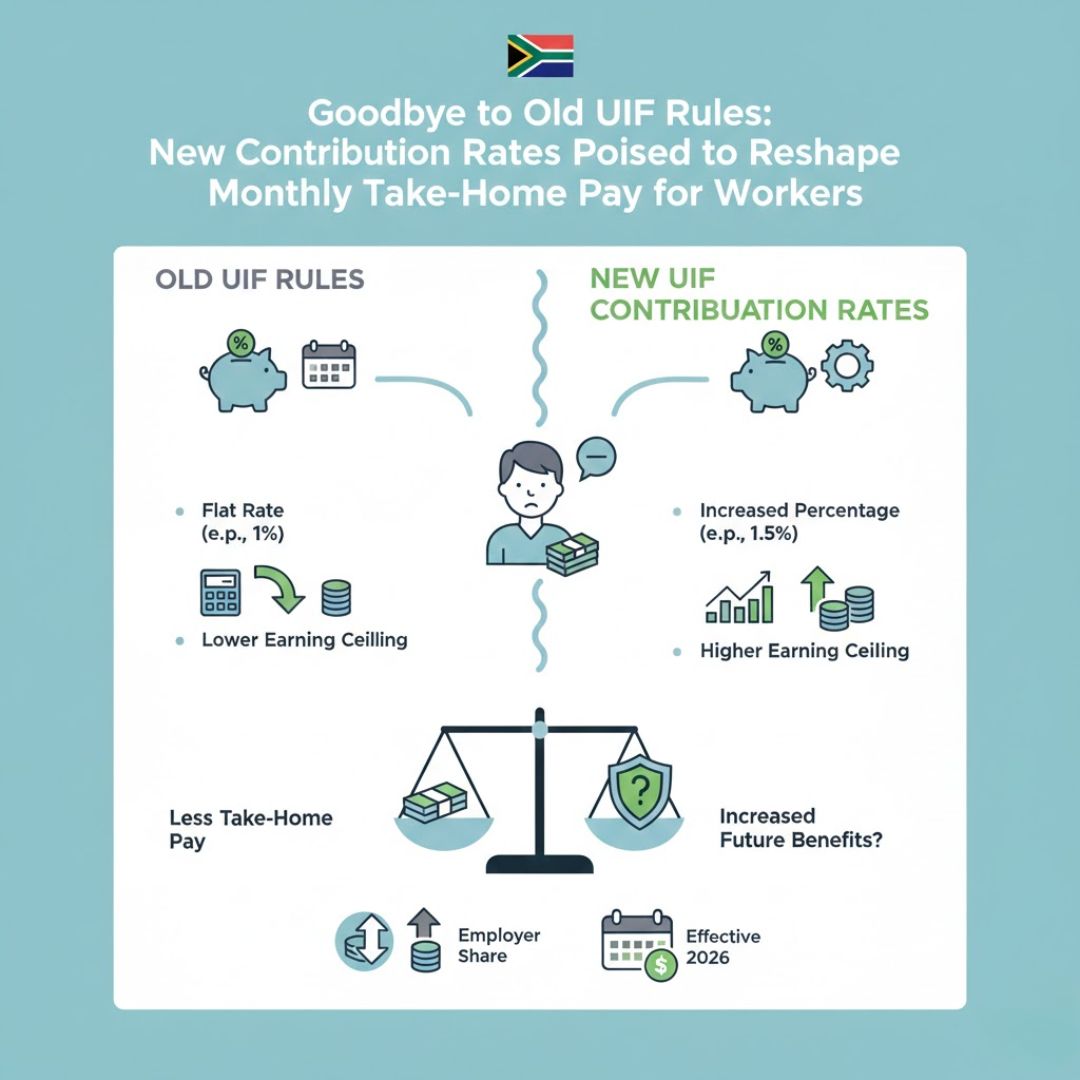

The South African unemployment insurance system is undergoing significant changes that will directly impact the monthly earnings of workers. As part of the reforms, new contribution rates are set to replace the old UIF rules, making workers’ take-home pay fluctuate. These adjustments aim to improve the social security framework and ensure more equitable benefits for contributors. In this article, we break down how these changes will affect South African workers and why it’s essential to understand the new contribution structure.

Understanding the New UIF Contribution Rates

The overhaul of the UIF contribution rates means that workers will now experience higher contribution percentages deducted from their wages. The new rates will apply to all employees, whether in the private or public sector. Employers will also need to contribute at a similar level to ensure the system’s stability. While this may reduce the immediate take-home pay for many, it is aimed at providing a more robust safety net for those facing unemployment or other emergencies. The new contributions are designed to balance worker protection and the long-term sustainability of the UIF system.

How Will These Changes Affect Take-Home Pay?

The increase in UIF contribution rates means workers can expect a slightly lower paycheck as a result of the higher deductions. For many, this change will be more noticeable in the monthly payslips, but it’s important to remember that the adjustments will benefit workers in times of crisis, such as job loss. For the average employee, the difference in take-home pay might be marginally noticeable, but it could have significant long-term effects on financial security. It’s essential for workers to adjust their financial planning strategies to account for this change.

Number Plate Rule Changes 2026: South Africa Updates the System and What It Means for Motorists

Number Plate Rule Changes 2026: South Africa Updates the System and What It Means for Motorists

Benefits and Challenges of the New UIF Rules

While the new UIF contribution rates may seem burdensome for workers initially, there are significant benefits to the system as a whole. The higher contribution rates will ensure that more funds are available to support workers in need of unemployment benefits, training opportunities, and other social services. However, there are challenges, particularly for those who are living paycheck to paycheck. Workers may face initial struggles to adjust to the increased deductions, especially in uncertain economic conditions.

Summary and Impact on Workers

The new UIF contribution rates are a necessary adjustment to strengthen the social security framework in South Africa. Although these changes may temporarily reduce workers’ take-home pay, they will lead to improved financial security in the long run. It is crucial for workers to understand how these adjustments will affect their finances and plan accordingly. The system’s sustainability will ultimately provide more comprehensive support for unemployed individuals, but financial literacy and adaptation are key to navigating the immediate effects.

| Category | Old UIF Contribution Rate | New UIF Contribution Rate | Effect on Workers |

|---|---|---|---|

| Employee Contribution | 1% of monthly salary | 2% of monthly salary | Increased deductions |

| Employer Contribution | 1% of monthly salary | 2% of monthly salary | Equal increase to employer |

| Benefit Amount | Limited to a lower percentage | Potentially higher payouts | Improved safety net for workers |

| Impact on Net Pay | Lower deductions | Higher deductions | Reduction in monthly take-home |

Frequently Asked Questions (FAQs)

1. What is the eligibility for UIF contributions?

All employees working in South Africa are required to contribute to UIF.

2. When will the new contribution rates take effect?

The new UIF contribution rates will be implemented starting in 2026.

3. How will these changes impact my salary?

You may see a reduction in your take-home pay due to higher UIF contributions.

4. Will employers share the increased burden of UIF contributions?

Yes, employers will also be contributing at a higher rate to match the increase.