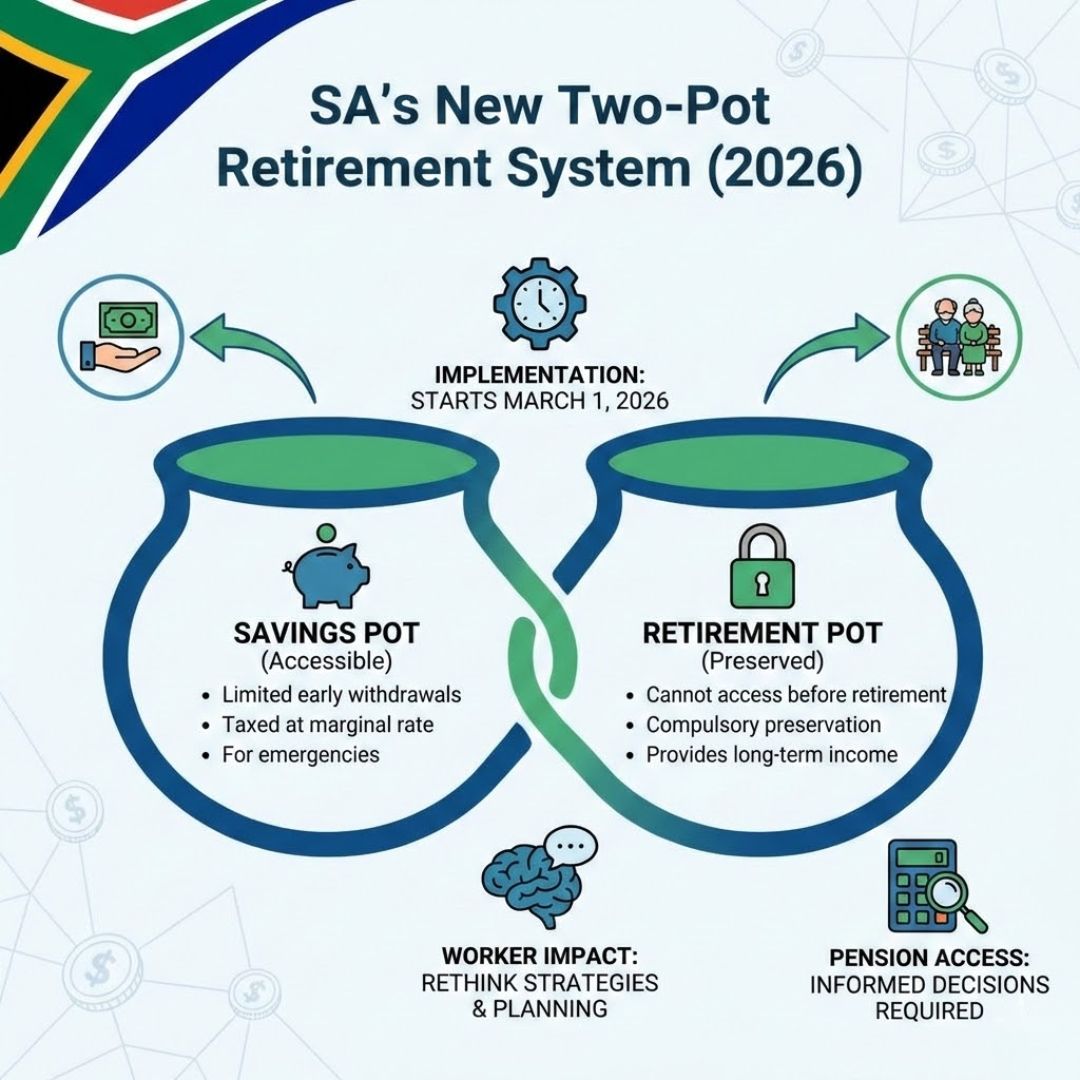

The Two-Pot Retirement System separates pension contributions into two clearly defined portions, each serving a specific role. One portion is set aside strictly for retirement, while the other allows limited and regulated early access. This design improves flexibility without promoting careless withdrawals.Under this structure, a share of savings remains preserved to protect long-term financial security, while the accessible pot provides support for genuine cash needs during employment. Importantly, strict limits on withdrawal amounts and frequency apply, reducing the risk of misuse.By combining financial discipline with controlled choice, the system encourages healthier saving behavior and lowers the chances of workers withdrawing entire pensions when changing jobs.

Why the Two-Pot Pension Model Was Introduced

This reform addresses real financial challenges faced by many workers who previously had to resign just to access retirement savings. Policymakers aimed to reduce unnecessary job exits while strengthening financial resilience during emergencies.Short-term pressures such as medical expenses or family responsibilities are common, yet the previous system offered no flexibility. By allowing limited and structured withdrawals, the new approach replaces full cash-outs with responsible access rules.At the same time, it supports a stronger retirement framework by promoting a culture of preservation, ensuring that funds remain invested longer and grow more effectively over time.

What Employees Need to Know About the Two-Pot Changes

Workers should understand how contributions are divided and what this means for future planning. While the system introduces flexibility, it still places retirement income protection at the center. Withdrawals from the accessible portion may be subject to taxation, making careful planning essential to avoid unnecessary losses. Employees should also be aware that frequent withdrawals can reduce long-term retirement outcomes.Although employers and retirement funds are expected to offer guidance, individuals must stay informed and make thoughtful decisions to maintain financial discipline within the new framework.

Goodbye to Low Old Age Pension: Monthly Senior Payments Increase Up to R2,400 from 8 February 2026

Goodbye to Low Old Age Pension: Monthly Senior Payments Increase Up to R2,400 from 8 February 2026

The Broader Impact of the Two-Pot Retirement System

Beyond personal benefits, the Two-Pot system may shape South Africa’s overall savings culture. By discouraging complete withdrawals, it contributes to system-wide stability and strengthens retirement funds over time.From an economic perspective, higher levels of preserved savings support stronger capital markets and more consistent investment flows. For individuals, the change promotes deliberate decision-making rather than stress-driven actions.If implemented effectively, the reform can achieve a balanced approach between access and preservation, improving retirement readiness while still acknowledging real-world financial pressures.

| Feature | Accessible Pot | Preservation Pot |

|---|---|---|

| Purpose | Short-term needs | Retirement income |

| Withdrawal Timing | Before retirement | At retirement |

| Tax Treatment | Taxed on withdrawal | Standard retirement tax |

| Access Limits | Restricted frequency | No early access |