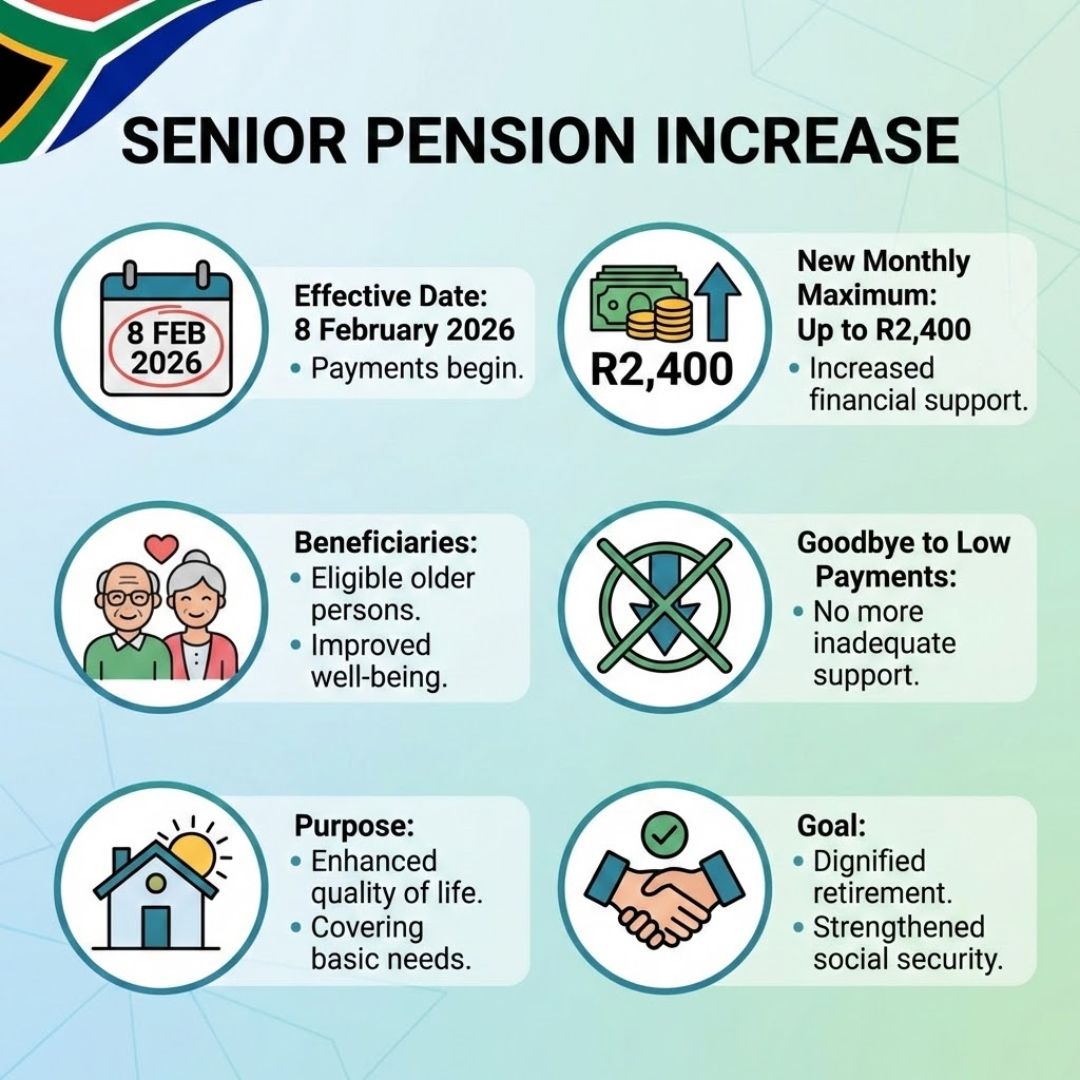

South Africa is preparing for a significant shift in social support for older citizens as the old age pension increase takes effect from 8 February 2026. This change is designed to ease financial pressure on seniors who are struggling with rising living costs, food prices, and healthcare expenses. With monthly payments rising up to R2,400, the update marks a meaningful step in strengthening income security for pensioners across the country. Many households that rely on this support are already planning ahead, as the adjustment could reshape budgets and improve day-to-day stability.

Old age pension increase brings higher monthly relief

The upcoming old age pension increase is more than just a routine adjustment; it reflects a broader effort to protect vulnerable seniors. From February 2026, qualifying recipients may see payments climb as high as R2,400 per month, depending on age and eligibility status. This uplift aims to support basic living costs, reduce stress around monthly household bills, and help seniors manage rising food prices. For many beneficiaries, the increase could also improve access to essential healthcare needs. While it may not solve every financial challenge, the higher payout is expected to offer practical, everyday relief that many older South Africans have been waiting for.

Who qualifies for the higher senior pension payments

Eligibility for the increased senior pension payments continues to follow established guidelines, but understanding them clearly is crucial. Applicants must meet age requirements and pass the means test, which assesses income and assets. The revised amount is especially relevant for those with limited personal income and minimal savings. Authorities stress the importance of keeping personal records updated to avoid delays. Seniors who already receive grants generally do not need to reapply, as adjustments are made automatically. However, new applicants should ensure they submit accurate application details and provide all required documentation to benefit from the enhanced support.

How the February 2026 pension changes affect seniors

The February 2026 pension changes are expected to have a noticeable impact on daily life for many seniors. A higher monthly payment can improve financial breathing room, allowing pensioners to better plan expenses and handle emergencies. Some may finally address delayed medical visits or afford safer transportation and utilities. Community organizations also believe the increase could strengthen local economic activity, as more pension income circulates within neighborhoods. While challenges like inflation remain, the revised pension level offers a more realistic cushion for older citizens trying to maintain dignity and independence.

What this pension increase means in the long run

Looking ahead, the pension increase signals a growing recognition of the pressures facing South Africa’s aging population. Beyond immediate relief, it may encourage better long-term financial planning among seniors and their families. Policymakers are also likely to monitor how the adjustment affects overall senior wellbeing and poverty levels. If managed carefully, the change could support healthier aging outcomes and reduce reliance on informal support networks. While ongoing reviews will be necessary, the 2026 update sets a foundation for more responsive social assistance in the years ahead.

| Category | Details |

|---|---|

| Maximum Monthly Amount | Up to R2,400 |

| Effective Date | 8 February 2026 |

| Target Group | Eligible senior citizens |

| Application Needed | No for existing beneficiaries |

| Assessment Method | Means-tested eligibility |

Frequently Asked Questions (FAQs)

1. When does the new old age pension amount start?

The increased payments begin from 8 February 2026.

2. What is the highest monthly pension amount?

Eligible seniors can receive up to R2,400 per month.

3. Do current pensioners need to reapply?

No, existing beneficiaries are adjusted automatically.

4. How is eligibility for the pension determined?

Eligibility is based on age requirements and a means test.