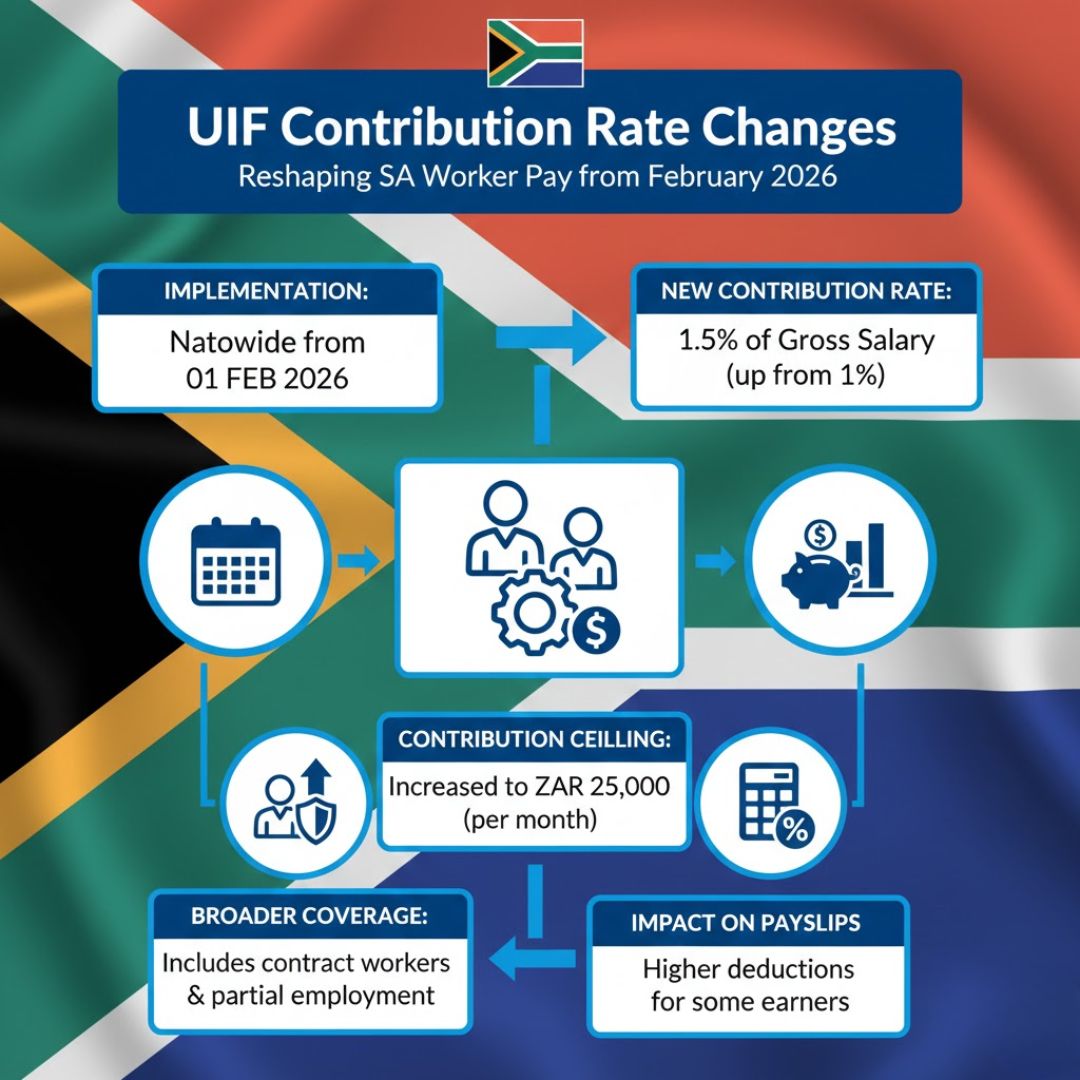

South Africa is preparing for a notable shift in how worker contributions are calculated, as the government plans to introduce revised UIF rules from February 2026. These changes are expected to affect both employees and employers, directly influencing monthly take-home pay and long-term social protection. The update aims to modernize the Unemployment Insurance Fund framework, align contributions with current income realities, and strengthen sustainability. For millions of South African workers, this marks the end of familiar deductions and the beginning of a system designed to better balance fairness, coverage, and financial resilience.

UIF contribution rate changes explained for 2026

The upcoming UIF adjustment introduces a recalibrated contribution structure that will apply across most income groups. Instead of a one-size-fits-all approach, the new model considers earnings more carefully, which could slightly alter deductions for many workers. While some employees may notice marginally higher contributions, the intent is to improve long-term fund stability and benefit access. Key ideas behind the shift include updated deduction rules, income-linked adjustments, fund sustainability focus, and fairer worker coverage. Employers will also need to update payroll systems to ensure compliance, making early preparation essential as February 2026 approaches.

How the new UIF rules affect South African workers

For employees, the most immediate impact will be seen on payslips. Even small changes in contribution rates can influence monthly budgeting, especially for households already managing rising living costs. However, the revised framework is designed to enhance protection during periods of unemployment, illness, or maternity leave. Workers may benefit from improved benefit security, stronger income protection, long-term payout reliability, and broader eligibility scope. While the short-term effect may feel like a reduction in take-home pay for some, the trade-off lies in a more dependable safety net when it matters most.

Employer responsibilities under revised UIF regulations

Employers in South Africa will play a critical role in implementing the new UIF contribution rates. Accurate calculation, timely submission, and clear communication with staff will be essential to avoid compliance issues. Businesses should prepare for payroll system updates, regulatory compliance checks, clear employee communication, and administrative process changes. Failing to adapt could result in penalties or disputes. Proactive planning, including staff briefings and system testing before February 2026, can help ensure a smooth transition for both employers and employees.

Understanding the broader impact of UIF reform

Beyond individual payslips, the UIF reform reflects a broader policy goal of strengthening South Africa’s social security framework. By adjusting contribution rates, the government aims to secure the fund’s future while responding to changing workforce dynamics. This reform encourages shared financial responsibility, system modernization goals, future benefit stability, and economic resilience planning. Over time, a healthier UIF could reduce pressure on other social support systems, offering workers greater confidence that assistance will be available when unexpected job disruptions occur.

| Aspect | Current UIF Rules | New UIF Rules (Feb 2026) |

|---|---|---|

| Contribution Basis | Flat percentage model | Adjusted income-based model |

| Impact on Payslip | Minimal variation | Slightly revised deductions |

| Employer Action | Standard payroll setup | Payroll system updates required |

| Fund Stability | Moderate sustainability | Enhanced long-term stability |

| Worker Protection | Existing coverage | Strengthened benefit security |

Frequently Asked Questions (FAQs)

1. When do the new UIF contribution rates start?

The revised UIF contribution rates are set to take effect from February 2026.

2. Will all South African workers be affected?

Most employed workers and their employers will be impacted, depending on income levels.

3. Will my take-home pay decrease?

Some workers may see slight changes, but impacts will vary by salary.

4. Do employers need to take action now?

Yes, employers should prepare payroll systems and communication plans ahead of 2026.