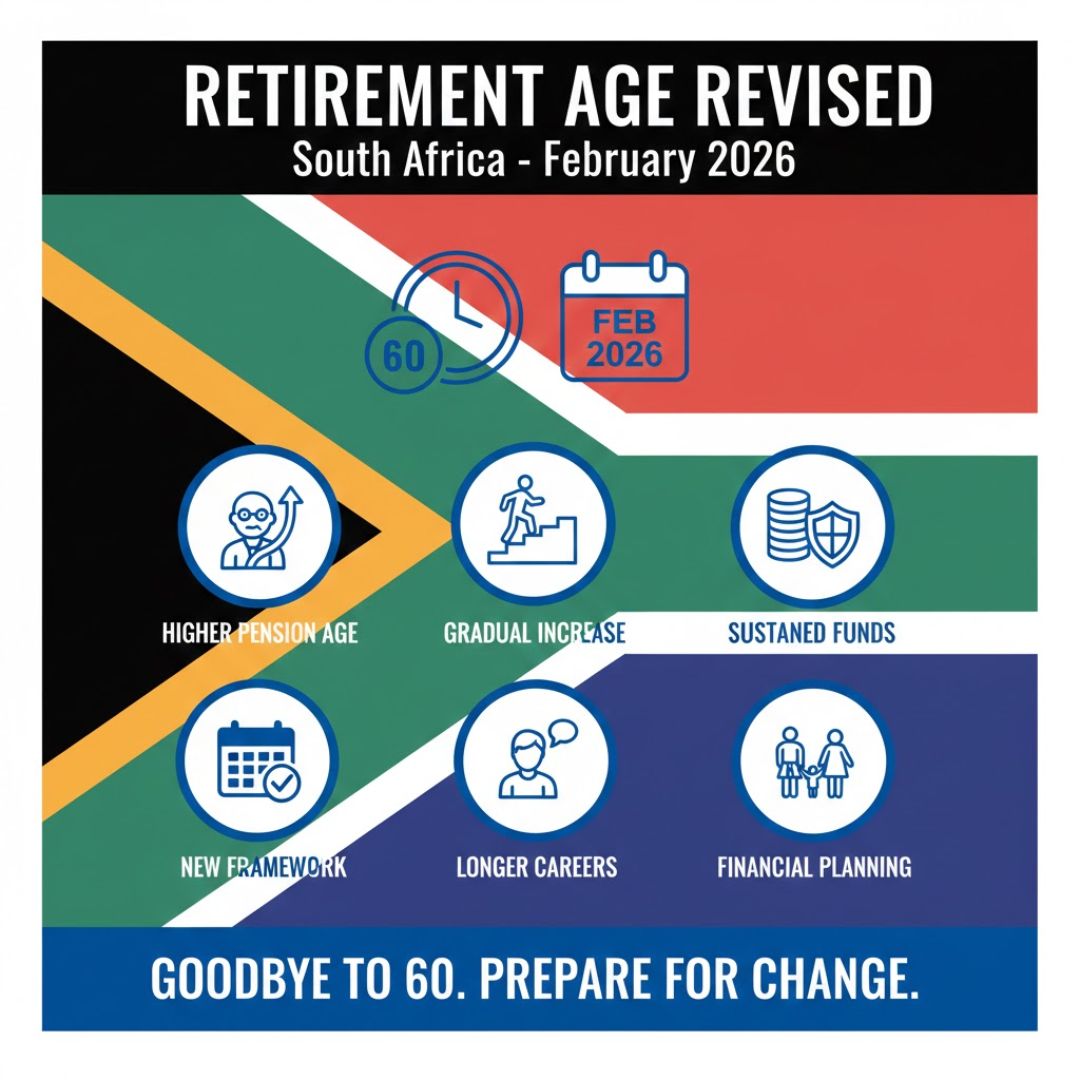

South Africa is entering a major transition in how retirement is defined and managed, as the long-standing expectation of retiring at 60 begins to change. From February 2026, a revised pension age framework will officially come into force, reshaping timelines for workers planning their later years. This shift affects not only public sector employees but also influences broader retirement planning across industries. Driven by economic pressure, longer life expectancy, and sustainability concerns, the new framework aims to balance social protection with fiscal responsibility while encouraging a more gradual move into retirement.

South Africa Pension Age Change Explained

The revised pension age framework marks a clear departure from past norms, where 60 was widely seen as the natural retirement point. Under the new approach, retirement will align more closely with demographic and economic realities, reflecting longer working lives. Policymakers argue this supports longer workforce participation while easing pressure on public funds. For many employees, it introduces adjusted retirement timelines rather than a sudden cutoff. The reform also emphasizes gradual exit options, allowing individuals to transition instead of stopping work abruptly. While change often brings uncertainty, officials believe the update creates future-focused stability for both workers and the national pension system.

Revised Retirement Framework and Workers

For current workers, the new pension age framework requires a rethink of personal plans and expectations. Those approaching retirement may experience extended employment periods, depending on their sector and role. This does not remove retirement benefits but adjusts when they can be accessed, aiming for fairer age alignment across professions. Employers are expected to adapt by offering flexible work arrangements that support older employees. The government also highlights skills retention benefits, noting that experienced workers remain valuable to productivity and mentorship, which helps the broader economy remain competitive.

Pension Reform Impact in February 2026

When the framework takes effect in February 2026, its real-world impact will become clearer. Employees will need to confirm how the changes apply to their specific pension schemes, as implementation may vary. Authorities stress clear communication plans to prevent confusion and misinformation. The reform supports financial system sustainability by spreading pension costs over longer periods. At the same time, it aims to protect dignity in later life through continued income security, ensuring retirement remains achievable even if it arrives later than previous generations expected.

What the New Pension Age Means Long Term

Looking ahead, South Africa’s revised pension age framework reflects a broader global trend toward later retirement. While some view the change as challenging, others see economic resilience goals at work, designed to stabilize public finances. Over time, the reform may encourage healthier aging lifestyles as people remain active longer. It also opens space for policy refinement opportunities if certain groups face hardship. Ultimately, success will depend on balanced social protection, ensuring that longer working lives do not come at the cost of wellbeing.

| Aspect | Previous Framework | Revised Framework (2026) |

|---|---|---|

| Typical Retirement Age | 60 years | Later, phased age |

| Access to Benefits | Immediate at 60 | Adjusted access timing |

| Work Transition | Abrupt exit | Gradual transition |

| System Sustainability | Higher pressure | Improved balance |

| Implementation Date | Before 2026 | February 2026 |

Frequently Asked Questions (FAQs)

1. Does this mean no one can retire at 60?

Retiring at 60 may still be possible in some schemes, but it will no longer be the standard benchmark.

2. When do the new rules officially start?

The revised pension age framework comes into force in February 2026.

3. Will current retirees be affected?

No, the changes mainly apply to those retiring after the new framework begins.

4. Why did South Africa change the pension age?

The shift aims to improve long-term sustainability while reflecting longer life expectancy.