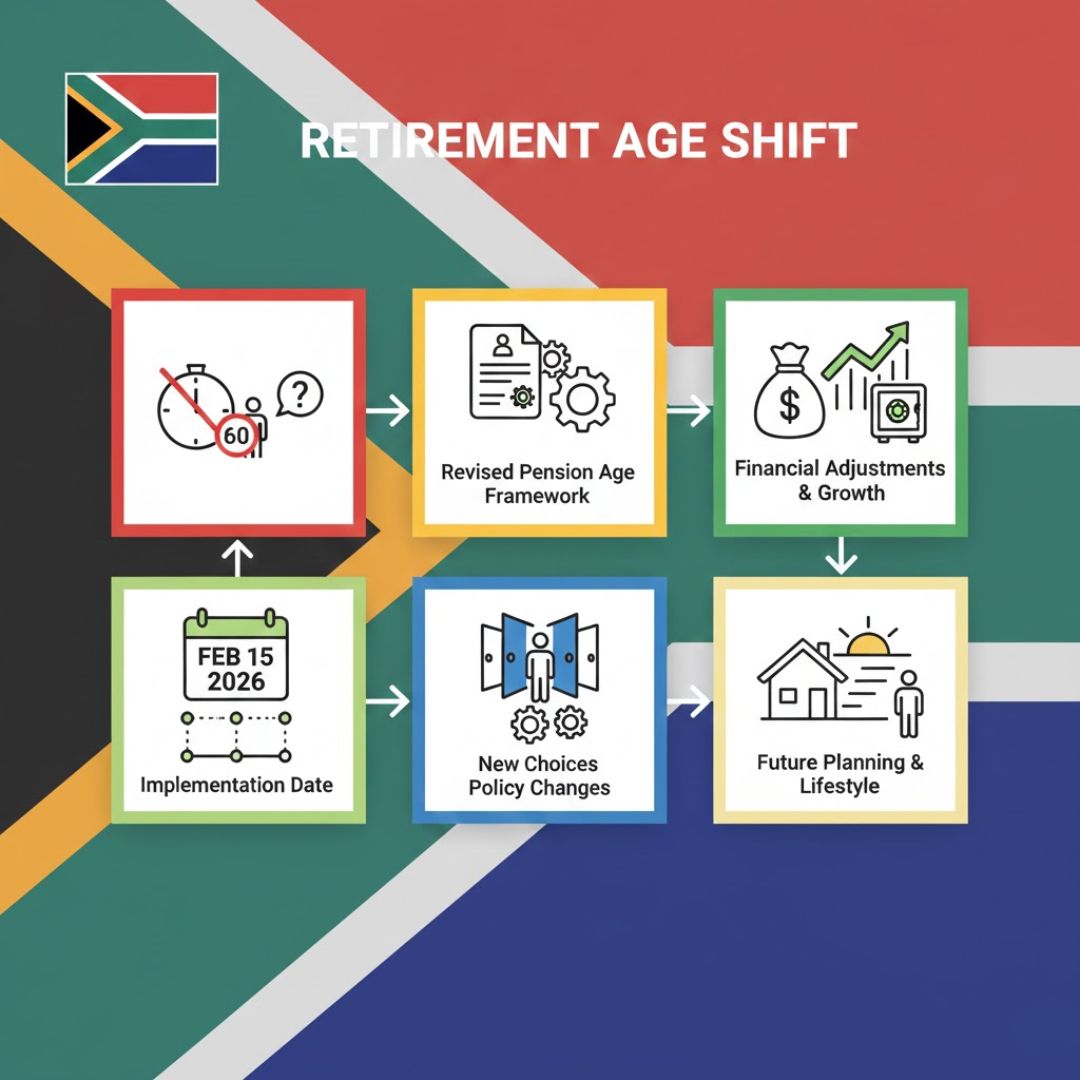

The South African pension system is undergoing significant changes with the introduction of a new retirement age framework, set to take effect on 15 February 2026. This shift marks the end of the long-standing tradition of retiring at 60, as the pension age will now be adjusted to align with global trends. This change will affect millions of South Africans who are planning their retirement or have already started their journey. Here’s everything you need to know about the new framework and how it will impact your future retirement plans.

The Revised Pension Age in South Africa

The revised pension age in South Africa represents a fundamental shift in the country’s retirement policies. Under the new framework, the pension age will gradually increase, beginning in 2026. The change aligns South Africa with global retirement trends and aims to address the growing financial demands on the public pension system. The government’s decision is partly due to increased life expectancy, which requires extending the working years for a more sustainable economy. This change will influence the financial planning for those approaching retirement, requiring careful adjustment to future expectations.

How the Shift Will Impact Pension Benefits

The impact on pension benefits will vary based on an individual’s current age and retirement plans. Those planning to retire at 60 will need to rethink their financial strategy, as the pension payout will be delayed. The new framework may also affect retirement savings plans, particularly for those relying on pension funds to cover their post-retirement expenses. It’s essential for future retirees to plan accordingly, considering the additional working years. While the change aims to stabilize pension systems, it also highlights the need for personal financial independence to bridge the gap before qualifying for pensions.

Government Plans for a Smooth Transition

The South African government is taking steps to ensure a smoother transition for those affected by the pension age change. This includes phased implementation, allowing people to adjust their retirement plans gradually. The government is also focusing on enhancing public awareness through campaigns and providing financial advisory services to guide individuals through this change. As a result, the impact of the pension age shift will be less abrupt for the average South African. It’s crucial to stay informed and prepare well for the long-term implications of these adjustments.

Summary and Analysis

The change in South Africa’s pension age marks an important shift towards a more sustainable retirement system. While the adjustment may feel unsettling for some, it reflects global trends and increasing life expectancy. With careful planning and government support, South Africans can still prepare for a comfortable retirement, despite the delay in pension payouts. As we move forward, it’s clear that individuals will need to balance public pension expectations with personal savings strategies to ensure a financially secure future.

| Eligibility Criteria | Retirement Age | Pension Payment Start Date |

|---|---|---|

| Born before 1960 | 60 years old | February 2026 |

| Born 1960–1965 | 61 years old | February 2027 |

| Born 1966–1970 | 62 years old | February 2028 |

| Born 1971 or later | 63 years old | February 2029 |

Frequently Asked Questions (FAQs)

1. What is the eligibility?

Eligibility for the new pension age depends on your birth year, with those born in 1965 or later seeing a gradual increase in retirement age.

Goodbye to Retirement at 67 as South Africa Overhauls Pension and Retirement Age Policies in 2026

Goodbye to Retirement at 67 as South Africa Overhauls Pension and Retirement Age Policies in 2026

2. How will the pension payments be affected?

Pension payments will be delayed by one year for each year the retirement age is increased.

3. Will this change affect current retirees?

No, the change applies only to those planning to retire after 2026.

4. How can I adjust my financial planning?

It’s important to increase savings and explore alternative income options to bridge the gap until retirement age.