SASSA Announces New Income Rule for Social Grant Recipients Starting 2026 The South African Social Security Agency (SASSA) has announced a new income eligibility requirement that will impact social grant recipients beginning in 2026. The agency has set an income limit of R8070 as the new threshold for qualification. This change aims to ensure that social assistance reaches households that need it most while keeping the grant system financially sustainable. The new rule means that applicants & current beneficiaries must have a monthly income below R8,070 to qualify for social grants.

How the R8,070 Income Threshold Works

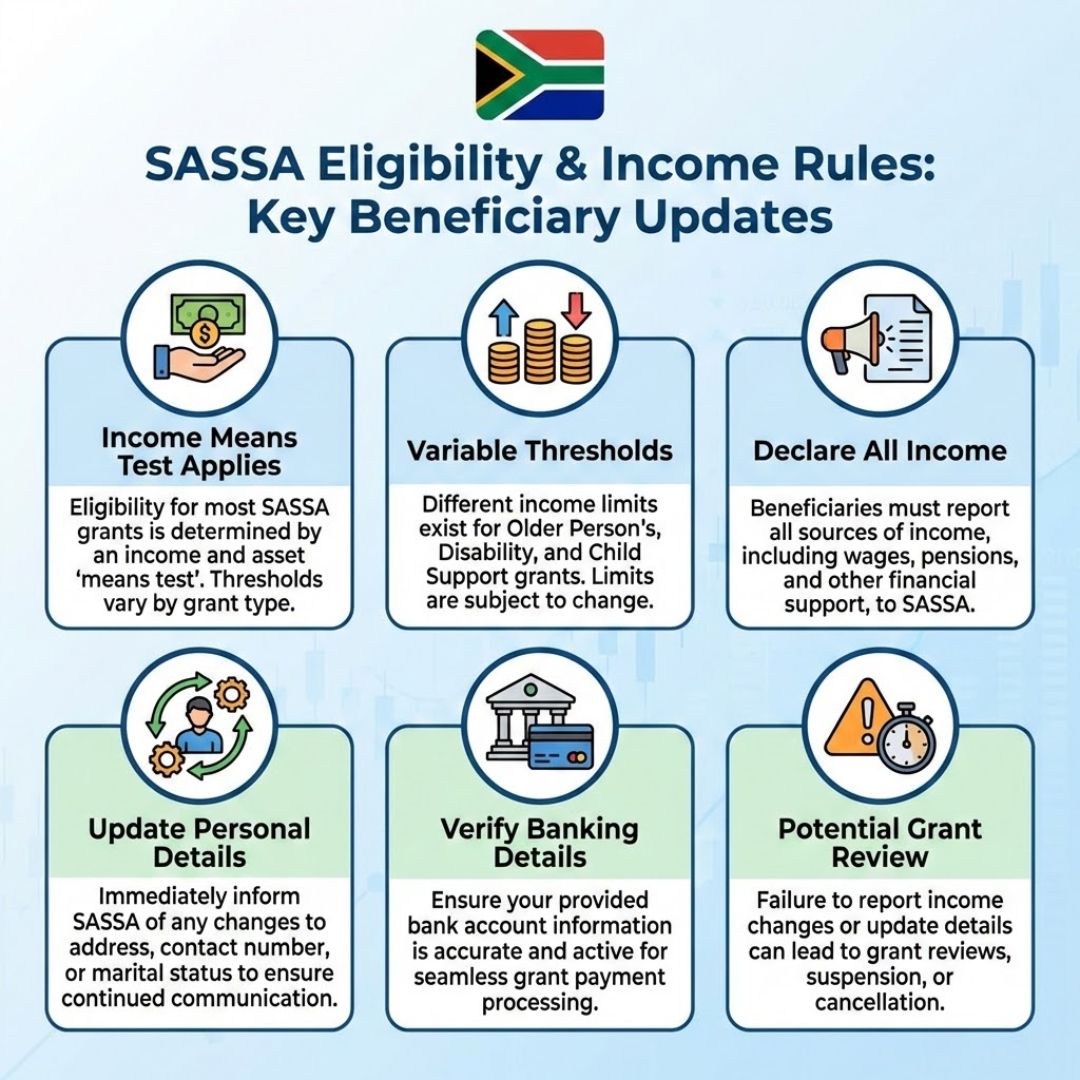

The updated rule introduces two groups of individuals who become ineligible for SASSA grants once their monthly income reaches R8,070. The income assessment covers all regular earnings, including wages from employment, informal work, pensions, business income, and other consistent financial sources. When a reassessment shows that household income exceeds the SASSA income limit, grant payments may be reduced or stopped.

Social Grants Covered Under the New Limit

The income ceiling applies to all means-tested social grants. These include the Older Person Grant, Disability Grant, Care Dependency Grant, and the Child Support Grant. Beneficiaries of these grants must comply with the revised income criteria to continue receiving payments. The new threshold is expected to affect households with multiple income earners most significantly.

South Africa Retirement Changes 2026: What the Two-Pot System Means for Your Pension and Withdrawals

South Africa Retirement Changes 2026: What the Two-Pot System Means for Your Pension and Withdrawals

Stricter Income Checks and Verification

To implement the updated rule, SASSA will introduce enhanced income verification measures starting in 2026. Beneficiaries may be required to submit bank statements, pay slips, employer confirmation letters, or affidavits. Failure to provide accurate and up-to-date financial information may result in the suspension or cancellation of grant payments.

What This Means for Current Grant Recipients

Existing beneficiaries will not lose their grants automatically under the new regulation. However, their financial circumstances must be reassessed using current income records. The revised threshold mainly affects recipients whose income has increased since their original approval. SASSA advises beneficiaries to regularly review their income status to avoid unexpected payment interruptions.

Steps Beneficiaries Should Take

Grant recipients are encouraged to calculate their total household income and ensure that all personal and financial details match SASSA records. Updates can be made through official SASSA offices or approved online platforms. Those who expect their income to exceed the threshold should prepare for possible benefit changes and explore alternative support options.

The Purpose Behind the R8,070 Rule

SASSA introduced the R8,070 income threshold to improve fairness and efficiency within the social grant system. By tightening eligibility requirements, the agency aims to ensure that assistance reaches South Africa’s most vulnerable households while managing the growing demand for social support.