For millions of unemployed South Africans the R350 Social Relief of Distress grant now paid as R370 remains one of the few available sources of financial support in 2026. With job opportunities still limited many applicants rely on this grant to cover basic needs. However strict income rules continue to determine who qualifies each month making it essential for beneficiaries to understand exactly what SASSA considers income. The SRD grant is designed for individuals with little to no financial support. To protect the system from misuse SASSA applies detailed income checks that can result in approval one month and rejection the next depending entirely on financial activity.

Understanding the Monthly Income Limit

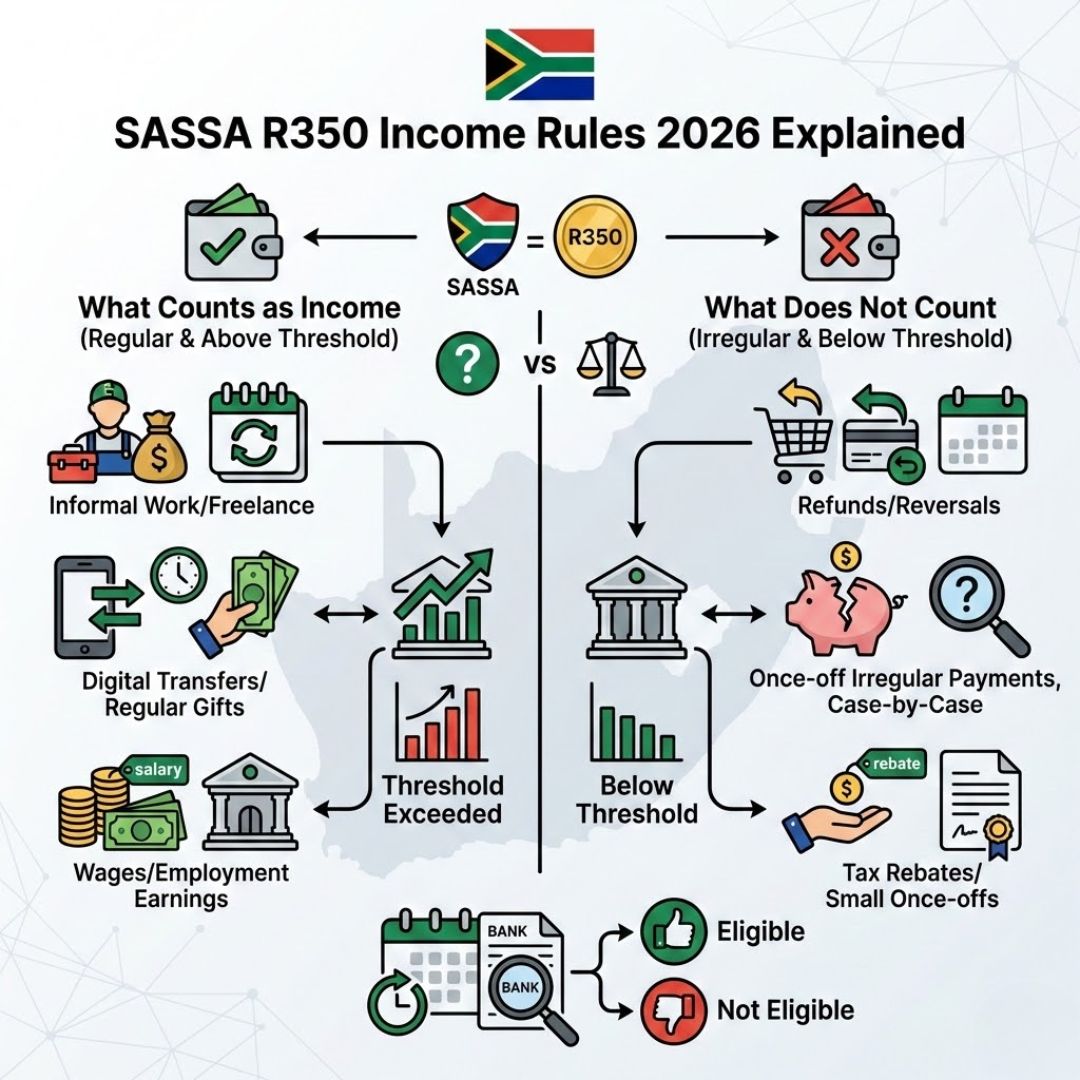

One of the most critical eligibility requirements for the R350 or R370 SRD grant in 2026 is the monthly income cap. Applicants must earn no more than R624 in total income during the assessment month. This amount includes all funds classified as income by SASSA, regardless of where the money comes from.If SASSA identifies deposits or earnings that push an applicant’s income above the R624 threshold, the grant will be declined for that specific month. This does not result in permanent disqualification. Eligibility is reassessed monthly, meaning applicants can qualify again if their income falls below the limit in later months.

How SASSA Reviews Income Every Month

SASSA carries out monthly income checks using bank verification systems and information provided by financial institutions. Each deposit into a registered bank account is examined as part of this process. This includes cash deposits, electronic transfers, and digital platform payments.Because income verification occurs every month, SRD approvals can change from one month to the next. An applicant approved in February may be declined in February if their income situation changes. This ongoing review explains why payment dates and approval outcomes vary for SRD beneficiaries.

Retirement at 65 Ends? South Africa’s New Age Rules Explained With Pension Impact and Next Steps

Retirement at 65 Ends? South Africa’s New Age Rules Explained With Pension Impact and Next Steps

Payments That Can Impact Your Eligibility

Regular or repeated deposits are most likely to affect SRD grant eligibility. Income from informal work, ongoing cash support from family members, and payments from freelance or short-term jobs may all be counted as income. Digital wallet transfers and person-to-person payments can also raise income flags if they occur frequently or exceed the allowed limit.Applicants should pay close attention to how money enters their bank accounts. Even small deposits can accumulate over the month and result in income exceeding the permitted threshold.

Payments That May Be Treated Differently

Not every bank deposit is automatically considered income. Certain once-off transactions, such as refunds, bank reversals, or rebates, may be assessed differently depending on the nature of the payment. These situations are reviewed individually, and exclusion is not guaranteed.Because SASSA relies largely on automated verification systems, any deposit that appears to be income may still trigger a review. This makes it essential for beneficiaries to understand their banking activity and ensure it accurately reflects their financial reality.

Main Reasons SRD Applications Are Declined in 2026

In 2026, most SRD grant rejections are linked to income-related factors rather than age or citizenship criteria. Common reasons include exceeding the monthly income limit, receiving regular deposits from unclear sources, and mismatches between personal details and banking information.Incorrect bank details are another frequent cause of rejection. Applications may fail verification if the bank account is not registered in the applicant’s name or if the details do not match official records.

Steps to Take If Your SRD Grant Is Declined

Applicants who believe their SRD grant was declined in error have the right to submit an appeal. Appeals must be lodged within the designated time frame and should include supporting information explaining why the detected income does not represent actual earnings.Each appeal is reviewed individually, and approval is not guaranteed. However, providing clear, accurate, and complete information improves the likelihood of a positive outcome.

How to Maintain Eligibility for the R350 Grant in 2026

Remaining eligible for the SRD grant requires ongoing attention and careful management. Beneficiaries should regularly check their SRD status online, confirm that their banking details are accurate, and avoid unnecessary deposits that could be interpreted as income.Having a clear understanding of the income assessment rules helps applicants prevent unexpected declines and plan around monthly reviews. With the SRD grant continuing to serve as a vital financial lifeline in 2026, staying informed is one of the most effective ways to safeguard ongoing access to this essential support.