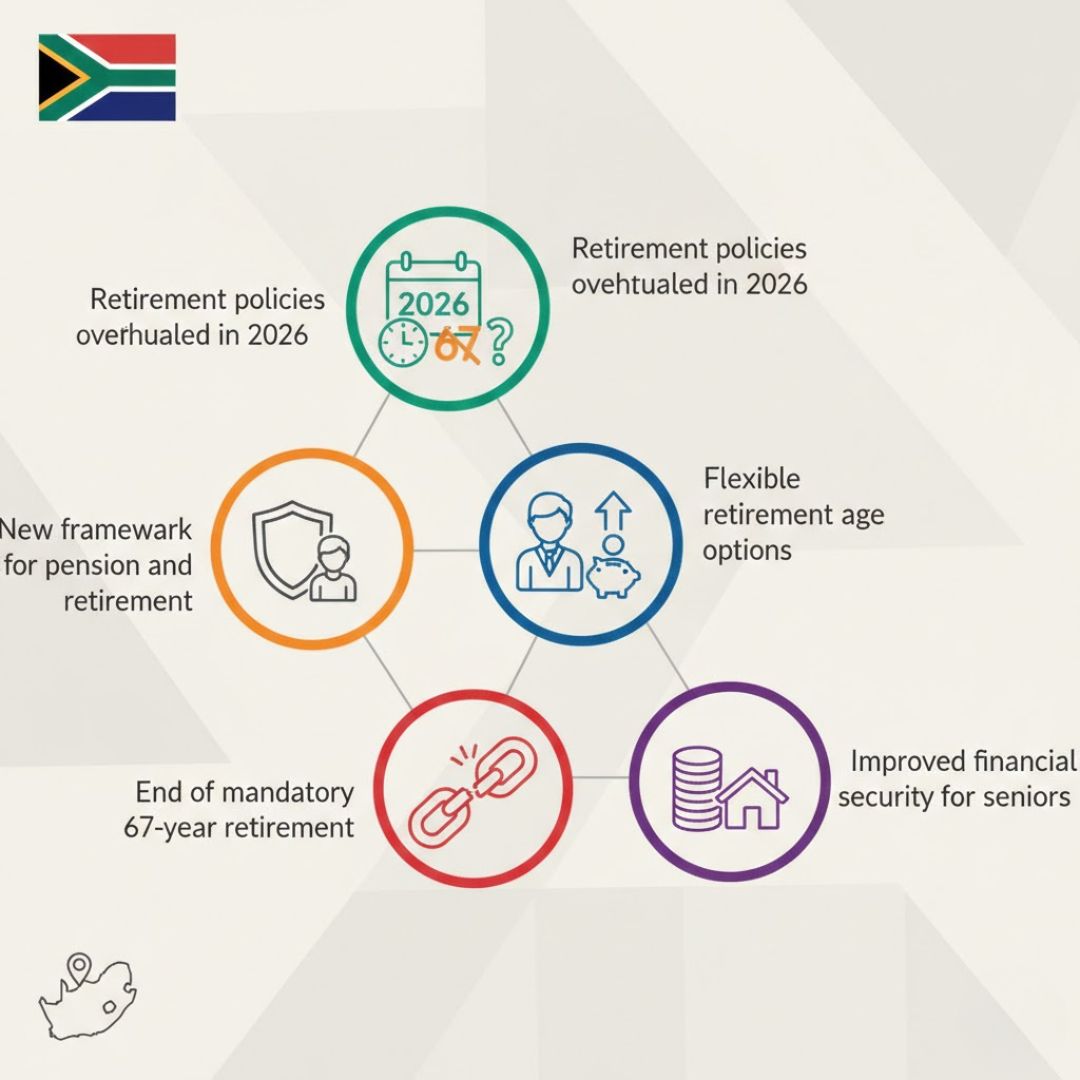

In 2026, South Africa will be overhauling its pension and retirement age policies, marking the end of an era where retirement at 67 was the norm. The country is making significant adjustments to the age at which individuals can start claiming their pensions, aiming to better align with the evolving economic landscape and population trends. This overhaul is expected to have profound effects on many individuals, particularly those who had been planning for retirement at 67. Understanding these changes is crucial for South African citizens as they plan for their future.

Changes to South Africa’s Pension and Retirement Age Policies

In recent years, South Africa has seen a shift in the national approach to retirement, with new pension and retirement age policies expected to reshape the landscape. The government’s decision to lower retirement age will impact many individuals who had initially planned to retire at 67. These changes are aimed at ensuring long-term sustainability of the pension system while also considering the increased life expectancy of South Africans. As the population continues to grow and change, the government is re-evaluating its approach to pension eligibility and age restrictions. For many, this will mean adjusting retirement plans to fit the new guidelines.

How the New Retirement Age Will Affect Your Benefits

The overhaul of retirement policies in South Africa will also influence how pension benefits are structured. As the retirement age is adjusted, individuals may find that their benefits are recalculated, with a longer work period potentially leading to higher contributions and payouts. Those who plan to retire early will need to consider alternative savings options or adapt to the new system. A shift in the pension structure could have financial implications for people nearing retirement, particularly those who have already begun planning for their golden years. The government aims to make this transition as smooth as possible by offering guidance and support through the process.

Goodbye to Old UIF Rules: New Contribution Rates Poised to Reshape Monthly Take-Home Pay for Workers

Goodbye to Old UIF Rules: New Contribution Rates Poised to Reshape Monthly Take-Home Pay for Workers

Implications for South Africa’s Future Workforce

South Africa’s decision to alter its pension and retirement age policies will have long-term effects on the future workforce. With a higher retirement age, younger workers may have to wait longer for job opportunities as older individuals continue working. This could lead to a shift in workforce dynamics and create new challenges for both employees and employers. The government will need to ensure that there are adequate employment opportunities for younger generations while also supporting older workers as they extend their careers. This change will likely encourage the re-skilling of older employees to keep them competitive in a modern economy.

Summary of the Retirement Age Overhaul

The South African government’s pension and retirement age overhaul marks a significant change in how the country approaches retirement planning. With the new policies, individuals will need to rethink their retirement strategies as they adjust to an evolving economic environment. While the new retirement age may seem daunting, it aims to ensure that pensions remain sustainable for future generations. It’s essential for individuals to stay informed about these changes and plan accordingly to safeguard their financial futures.

| Eligibility Criteria | Old System | New System |

|---|---|---|

| Retirement Age | 67 | 65 |

| Pension Contributions | Mandatory from age 18 | Mandatory from age 21 |

| Early Retirement Option | Available at 60 | Available at 58 |

| Pension Fund Payout | At retirement age | At 65 or later |

Frequently Asked Questions (FAQs)

1. What is the eligibility for the new retirement system?

The new retirement system allows individuals to start receiving pension benefits at 65 instead of 67.

Number Plate Rule Changes 2026: South Africa Updates the System and What It Means for Motorists

Number Plate Rule Changes 2026: South Africa Updates the System and What It Means for Motorists

2. Will the pension contributions change under the new system?

Yes, pension contributions will be mandatory from the age of 21, rather than 18.

3. Can I retire earlier than 65?

Yes, early retirement options are available at age 58, with adjusted benefits.

4. How will the changes affect my pension payouts?

Pension payouts will now begin at age 65, potentially adjusted based on contributions.