South Africa is getting ready for major retirement rule changes in 2026 that will affect how & when workers can access their pension benefits. These updates are part of broader reforms designed to make retirement funds more sustainable while dealing with the fact that people are living longer and need enough income during their retirement years.

Changing Expectations Around Retirement Age

Retirement timelines are shifting as modern social and economic conditions make working longer more achievable than in the past. Many South Africans who once planned to retire between ages 60 and 65 are now being advised to remain employed for several additional years. For public sector employees and members of regulated retirement funds, retirement ages are increasingly moving closer to 67, allowing individuals to extend their contributions and build stronger long-term retirement savings.

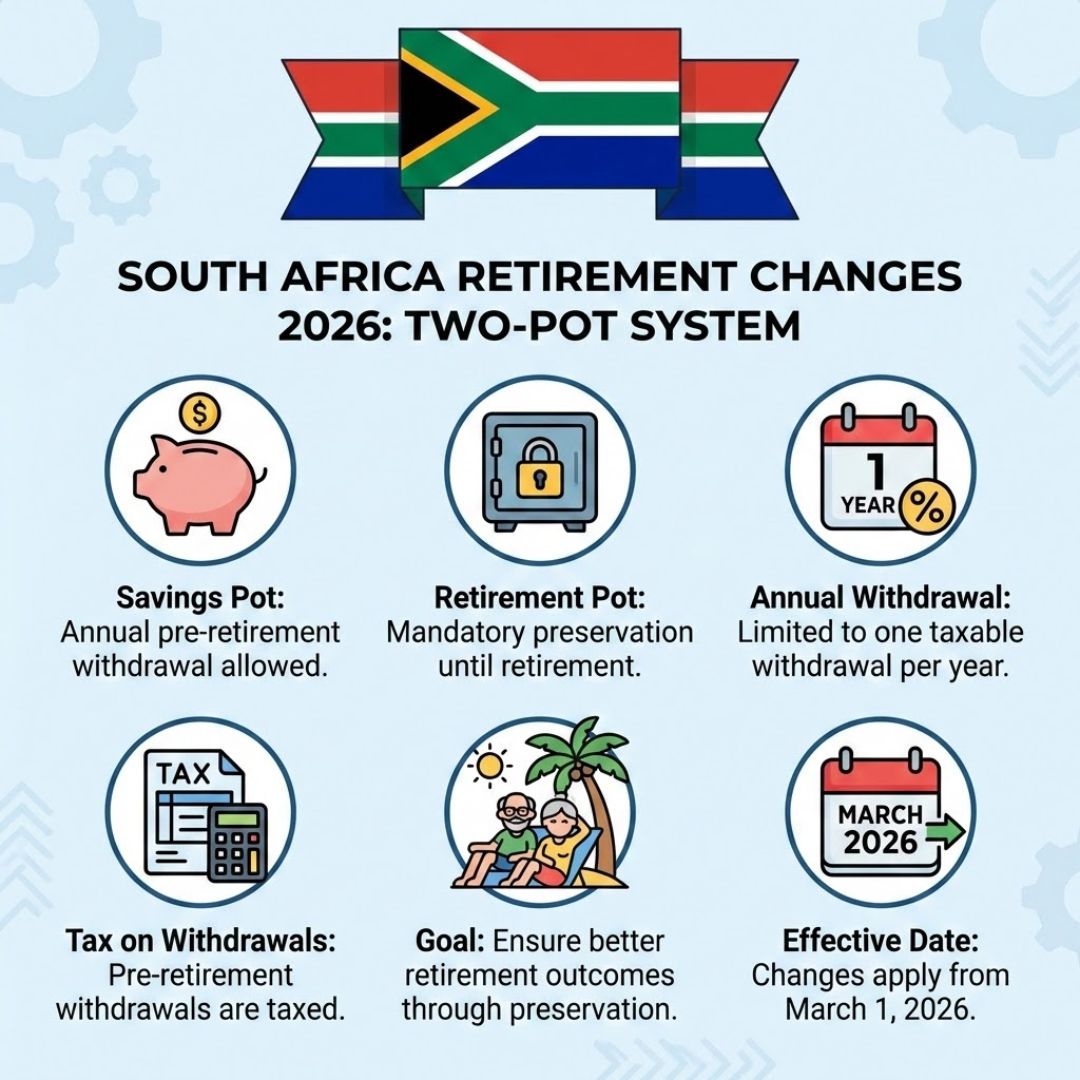

The Ongoing Role of the Two-Pot Retirement System

The two-pot retirement system continues to play a key role in retirement planning in 2026. This structure separates contributions into two distinct portions. One portion is preserved strictly for retirement, while the other allows limited access before retirement under defined circumstances. This approach offers flexibility for short-term needs while ensuring that long-term funds remain protected, preventing members from fully depleting their savings prematurely.

Tighter Controls on Early Pension Access

New retirement reforms coming into effect in 2026 introduce stricter rules on early withdrawals. While emergency access to funds is still permitted, increased monitoring is designed to prevent early withdrawals from becoming routine. These safeguards are intended to reduce the growing risk of inadequate retirement savings, which has become a more pressing concern in recent years.

How the Changes Affect Workers Near Retirement

Employees approaching retirement are encouraged to reassess their financial planning strategies. Working for longer can lead to higher pension payouts, but it may also delay access to retirement income. Individuals in physically demanding roles or those facing health challenges should explore alternative savings options and flexible employment arrangements to help maintain financial stability if early retirement becomes necessary.

Why Regular Retirement Reviews Matter

Financial advisors are strongly recommending that South Africans review their retirement plans regularly as updated rules take effect. Understanding fund policies, contribution thresholds, and withdrawal conditions is essential, as these factors directly influence whether savings remain preserved. Staying informed allows workers to make clearer decisions about retirement timing and future income.

Looking Ahead to the Future of Retirement

The retirement reforms scheduled for 2026 reflect a long-term transformation in how retirement is structured in South Africa. Although these changes introduce new responsibilities for workers, they are designed to provide stronger financial safeguards for future retirees and improve the overall resilience of the national pension system.